February 15, 2024

Setting wages is a key aspect of running a business. While setting wages is not an exact science, there are 5 key considerations to determine fair and competitive wages that when employed, gives your business the confidence that it can attract and retain skilled employees. In this tight labour market, every opportunity to gain a competitive advantage is worth exploring and labour costs are one of the larger business expenses that exist.

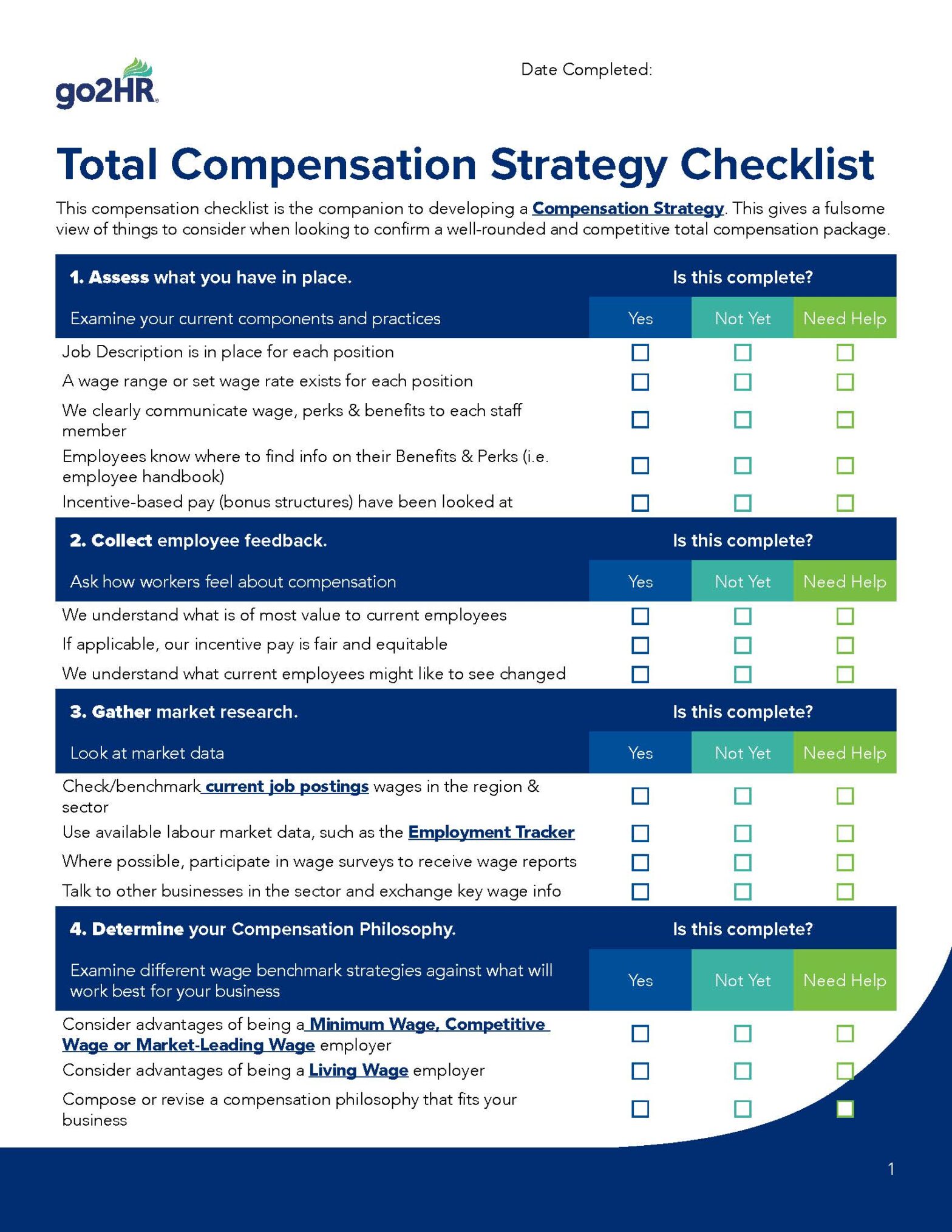

In a typical total compensation mix, wages account for 70-75% of overall compensation while the remaining 25-30% is a combination of incentives, intrinsic rewards (i.e. scheduling flexibility), and perks & benefits. Our Compensation Worksheet Template and Pay Statement Sample can help you determine your current mix of total compensation and play around with the effect of adjusting variables on total compensation as a whole. Larger businesses are generally advised to go through the process of also creating a Compensation Strategy, of which setting wages is a component, but generally not needed at the small-business level.

Regardless of which stage your business may be at in setting wages, ensuring that they reflect your business is paramount. Feel free to get in touch with your Regional HR Consultant at any time to help you through the process of setting wages and/or total compensation.

5 Key Considerations to determine fair and competitive wages

1. Evaluate Skillset and Experience

The skills, experience, and qualifications of employees play a significant role in determining wages. Employees with specialized skills or extensive experience tend to have higher wages compared to entry-level workers

- Consider the experience and skillset or qualifications for positions when determining wages. Someone with 5 years of experience typically would be paid more to start than someone with zero experience as would positions with requirements for safety or service certificates or other position-specific certifications would start at a higher wage than someone without these

- Consider also the level of responsibility required for the position. Does this position have additional responsibilities such as oversight for first aid or being a shift lead or a supervisor? Employees who perform additional duties during designated shifts, typically receive a shift-premium for those shifts (e.g. Shift lead or First Aider), while supervisory positions typically have a higher base wage attached to them

2. Comply with Legal Requirements

Every employer is required to comply with BC Employment Standards and wage regulations. The Employment Standards Act sets out minimum wage rates, overtime pay requirements, and rules regarding deductions from wages. It’s essential for employers to familiarize themselves with these regulations and ensure that their wage practices comply. Keep in mind:

- Annual BC Minimum Wage increases take effect on June 1st each year. Amount varies annually and is based on inflation.

- Provincial and Federal payroll source deductions (CPP, EI, taxes) add to the cost of labour

- Positions that are eligible to receive gratuities – If it hasn’t already, the business has to decide whether gratuities will be controlled or uncontrolled by the employer. How gratuities are managed and shared may factor in to the base wage that a business chooses to set for a position. More information: Tip and Gratuity Compliance

- BC’s new Pay Transparency Act introduced rules around the posting of wages, asking people about their current or colleagues’ wages, and filing transparent wage reports (depending on the size of your business)

3. Promote Pay Equity

Employers should conduct regular reviews to identify and address any disparities in wages among employees performing similar work.

- Set wages by focusing on paying the position, not the individual. While it may be tempting to set or increase wages based on an individual who is currently doing the job, these short-term decisions can have future implications should they leave (what would you pay a new person?), and may lead to unconsciously biased wage determinations. Consider the required qualifications, skills, experience, level of responsibilities etc. for each position and how it compares to other positions (e.g. supervisors, managers) in order to set a wage/salary rate or range for each position. Then, ensure that every individual who is doing the same job is paid the same, based on that rate or range.

- Internal pay equity ensures that employees are compensated fairly based on factors such as job responsibilities, performance, and tenure. Pay attention to this when setting wages ensure that someone new for example, isn’t making more than someone with more tenure in the same position.

- Review wages to maintain competitiveness. Make it a practice to regularly review employee wages (e.g. annually) and be prepared to adjust them accordingly. Take a look at internal pay equity, gender equality and market competitiveness (see next section). Be aware of wage compression which can happen if some wages increase while others don’t (e.g. when minimum wage increases annually as required by law, and other hourly or salaried positions remain same). This can become a challenge when lower wages increase to a point where they get close to, meet or exceed wages paid to other positions (e.g. supervisors, managers). If left alone may impact retention of skilled employees.

- Ensure financial sustainability. Small business employers may have a desire to pay all employees top-dollar however all wage decisions need to be financially sustainable over time. Some positions may also require a higher level of pay in order to attract or retain skilled employees than others.

- Certain positions will cap-out at a top wage and that is okay. When that happens, consider bonuses or incentive pay as a way to recognize performance or tenure

4. Research Market Trends

Conducting market research to understand the prevailing wage rates for similar positions will give you a benchmark for setting competitive wages. It will also assist when conducting regular wage reviews to identify market fluctuations and make wage adjustments as needed to attract and retain employees over the long term.

- Use Wage Benchmarks to determine how you want to position your wages. [Note: If you are a larger employer, the Compensation Philosophy you have for the company will guide these decisions. See Compensation Philosophy.]

- Consider what direct competitors are paying for comparable positions in your city, region and sector

- Consider what indirect competitors are paying for similarly skilled positions in other sectors such as for maintenance, I.T., accounting, or HR positions

- Consider the cost of living. The cost of living varies significantly across different regions of the province. Employers should consider factors such as housing costs, transportation expenses, and other living expenses when determining wages. Adjusting wages to reflect the local cost of living ensures that employees can maintain a reasonable standard of living. More information on Minimum Wages and Living Wage

5. Factor in Perks and Benefits

In addition to base wages, employers may offer perks and benefits as part of their total compensation package. When determining wages, it’s important to consider the value of these benefits and their impact on overall compensation. Use one of the Compensation Worksheet Template and Pay Statement Sample to assist.

Conclusion

Setting wages requires careful consideration of various factors, including skillset and qualifications, market trends, cost of living, and legal requirements. By following these guidelines and prioritizing fair and competitive wages that reflect the value of their employees’ contributions, tourism and hospitality employers can create a supportive and rewarding work environment that truly attracts and retains skilled employees, even in a tight labour market.

Return to top